Retirement Plan Limits Going Up!

Submitted by ClearBridge Wealth Management on December 12th, 2019December 12, 2019

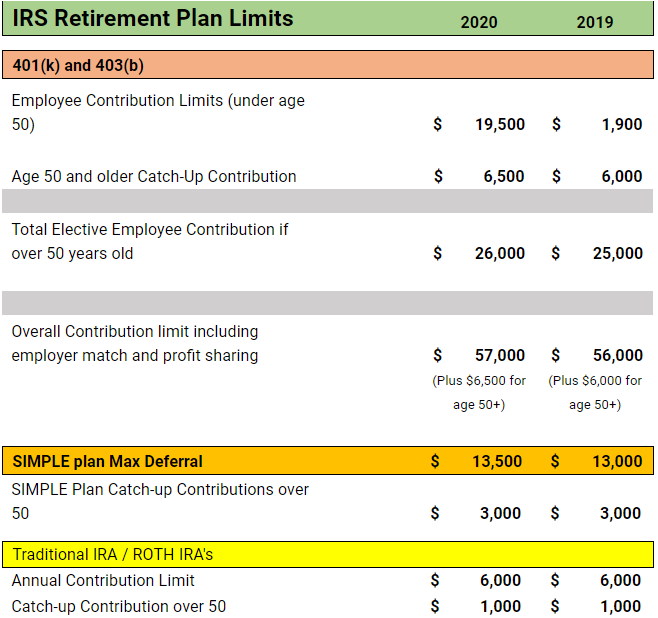

Starting January 1, 2020, you will be able to save and invest more thanks to an increase in the dollar limitations for certain retirement plans. The contribution limit for employees who participate in 401(k), 403(b), and most 457 plans will increase from $19,000 to $19,500. The catch-up contribution for employees over 50 also increased from $6,000 to $6,500. Therefore, employees over 50 years old can now contribute up to $26,000 ($19,500 for those under 50) not including the company match or profit-sharing contribution on an annual basis.

Contributions to SIMPLE plans also increased from $13,000 to $13,500 for 2020. Traditional and ROTH IRA’s stayed the same $6,000 ($7,000 if you are over 50).

Make sure you contact your Human Resource department or payroll company to increase your contributions for the new year.

As always if you have any questions, I encourage you to contact me.

Source: www.ssa.gov and IR-2019-59 at www.irs.gov