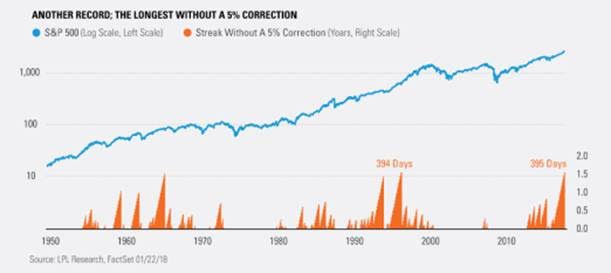

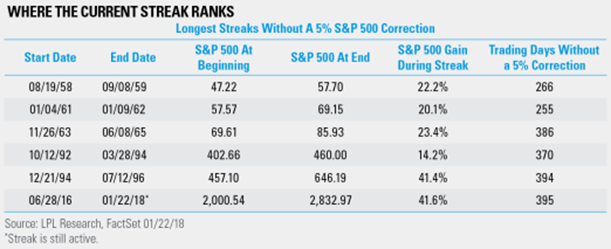

The Longest Streak Ever Without a 5% Correction

Submitted by ClearBridge Wealth Management on January 25th, 2018Incredibly, the S&P 500 Index has now gone a record 395 trading days in a row closing within 5% of its all-time high—just topping the 394 days seen during the mid-1990s. This is huge news! Other than a Brexit- induced single day sell-off in late June 2016, 466 of the past 467 trading days have closed within 5% of the all-time high.

Per Ryan Detrick, LPL Senior Market Strategist, “This is a long time without a correction, but remember that the S&P 500 went on to gain for another four years, and more than double after that mid-1990s streak ended. It was no doubt a rocky ride, but it was also far from the end of that bull market. In other words, once this incredible streak ends, don’t expect the bull to end with it; as he could have a few more tricks up his sleeve.”

We see a similar path playing out with more volatility likely in 2018; but with the economy as strong as it is, we don’t see an end to this global bull market anytime soon either.

Last, here’s what this streak looks like compared to others; quite interesting that the S&P 500 has gained just over 40% during the streak, similar to the mid-1990s.

If you have not done so already, please follow us on Facebook. It is an excellent way to keep up with current events and receive timely information like this. As always if you have any questions, I encourage you to contact me.

J. Preston Byers CPA CFP

President