How Normal Is This Correction?

Submitted by ClearBridge Wealth Management on February 16th, 2018February 13, 2018

The S&P 500 Index officially pulled back into correction territory last week for the first time since early 2016. The widely accepted definition of a correction is a 10% decline from the most recent high. What made this correction so unique is that it was the first time the S&P 500 has ever gone from a new all-time high to a correction in nine days or less. Such a quick pullback can be very unnerving, to say the least, but is often necessary to maintain a healthy market environment.

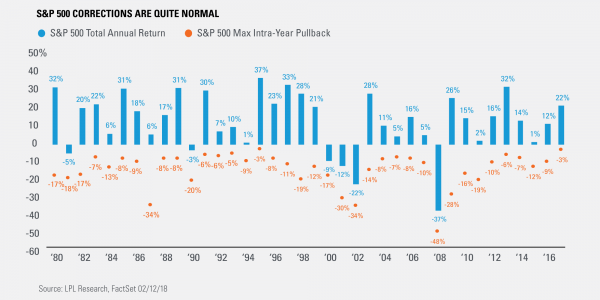

After one of the most tranquil equity markets in history last year, seeing a pickup in volatility in 2018 shouldn'tt be a surprise. In fact, a continuation of the bull markets amid higher volatility has been one of our main themes for 2018 as expect a return of the business cycle. We looked at all 36 S&P 500 corrections since 1980 but we also think the max intra-year pullback, along with the total return for the S&P 500 for each calendar year starting in 1980, provides a few more helpful takeaways:

- The average max intra-year pullback is 13.7%; compare that to 2017's 2.8%

- Half of all years (19 out of 38) saw at least a 10% correction during the year

- 13 of the 19 years with a correction finished higher on the year

- The average total return for the S&P 500 during a year that had a correction was 7/2%

“The reality is a 10% correction is quite normal. In fact, years that have a correction but don’t fall into a recession tend to bounce back and usually finish green for the year. With our analysis suggesting little chance of a recession over the next 12 months, recent weakness could prove to be a buying opportunity for long-term investors,” according to LPL Senior Market Strategist, Ryan Detrick.

As always if you have any questions or concerns, I encourage you to contact me. If you have not done so already, please follow us on Facebook. It is an excellent way to keep up with current events and receive timely information like this.