Are We Out of the Woods Yet?

Submitted by ClearBridge Wealth Management on February 25th, 2018February 21, 2018

After the fastest correction from a record high in the history of the S&P 500 Index, stocks staged an impressive comeback last week. The S&P 500 gained more than 5% off the lows to bring its session win streak to six before yesterday. So does that mean we are out of the woods? Weighing the technical evidence suggests the worst may be behind us. After signs of panic selling, the S&P 500 rebounded strongly from oversold levels and the bullish trend has remained intact. The stock market’s strong fundamentals also suggest the worst of the sell-off may be behind us. U.S. economic growth is accelerating, consumer and business confidence remains high, inflation is rising but remains relatively low, and earnings season has been excellent.

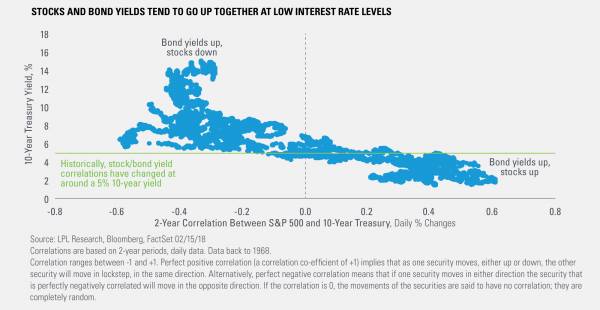

So how concerned should we be about rising interest rates at this point? As LPL’s Chief Investment Strategist John Lynch notes, “When rates are relatively low, rising rates usually indicate improving growth, as is evident today. At higher interest rate levels, rising interest rates have tended to spook stock investors as the Federal Reserve gets more aggressive and borrowing costs rise.” With the 10-year yield not having eclipsed 3% during this latest bond market sell-off, we think we have a ways to go before the level of interest rates impairs economic activity or the stock market. Figure 1 illustrates how stocks and rates have historically moved together at low interest rates levels; correlations between the S&P 500 and interest rates have been positive when the 10-year Treasury has been below 5%, as it is today. History also suggests stocks valuations are reasonable for current inflation levels.

As always if you have any questions or concerns, I encourage you to contact me. If you have not done so already, follow us on Facebook. It is an excellent way to keep up with current events and receive timely information like this.